Equity in real estate is the value of your house minus what you owe. Many factors impact the value of your home. For instance, your loan term and down payment each impact it. Market forces are also a big factor that you have no control over. However, you can make payments on time, and that will reduce what you owe.

- As housing prices rise your home’s equity increases

- As you pay down your mortgage it also increases

The market has some impact on how much value is stored up in your home. However, you can control paying your bill on time, maintaining your property, and not borrowing against your home. These all have an impact on how much value is stored up in your home.

Click to Open Outline

What Does It Mean to Have Equity in a Home?

If you have equity in your home your house is worth more than you owe. In a practical sense, it’s the amount of money you will get if you sell your home. An example may be helpful.1

If you buy your house for $200,000. You put 20% down ($40,0000). You take out a 30-year mortgage paying 5% interest, make payments on time every month and live there for 10 years. In our hypothetical example, it increases in value to $250,000.

- $40,000 down payment becomes equity

- $50,000 increase in value becomes equity

- The principal payments (excluding interest) to the bank counts towards the estate

With a monthly payment of about $1,140 (this will include taxes and interest) the amount you owe after 10 years is about $86,500. Since the market value is $250,000 you subtract the amount you owe to get a value of $163,500.

Is Equity Real Money?

Equity in real estate is real money, but it is not very liquid. This means you cannot easily convert it to cash. In the example above:

- You would have to pay transaction costs, such as realtor fees, so you would not get $163,500

- Your home may not sell for market value. It may sell for less, but it also might sell for more

- Property transactions take time to market and sell, so you won’t get the money quickly

Real property is one of the least liquid kinds of assets. Therefore, it may seem that the $163,500 in the example above isn’t real money. Further, even if you sell your home for fair market value, you won’t walk away with all the equity because of fees. However, if you do sell your home you can trace all that equity to payments in real dollars, so yes, it is real money.

What is the Point?

The point of equity in real estate is that your investment, the land, increases in value over time. While you live in your house it builds your wealth. Almost no other tangible investment does that.

- Other practical items you may take out a loan for, such as a car, depreciate over time.

- The structure of your house also depreciates, but the land appreciates.

- Many investors describe houses as “forced savings accounts” because they build wealth over time

You should not look at your house solely as an investment because it is your home, but it stores wealth over time. If you properly maintain the property you build considerable wealth in your home.2

What is the Purpose?

The purpose is that you have a valuable, practical asset that appreciates, and you can sell for profit. Why is this important? Because it is your largest investment, and it is where you store the greatest percentage of your wealth. You can use the money in your home to:

- Buy another home

- Borrow against the value in the home

- Fund retirement

People use their homes for all these reasons. It is hard to convert your house to cash, so it is an excellent store of value. Unlike your checking or even savings, account you won’t easily take money out of your house.3

Do You Have to Pay Back Equity in Real Estate?

You do not pay back the equity in your home. It is your money because you are paying for your home in the form of your mortgage. Eventually, you will pay off your loan (if you don’t sell your house first), and then you will own the property and its entire value.

- It is the value that accumulates as you pay off your mortgage

- It also increases as land values grow over time

Anything that you must pay back is a liability, but your home is an asset. While there are liabilities associated with it (like maintenance of the structure), the property is an asset that you own.

Why is Equity in Real Estate Important?

Equity is important in real estate because it is your largest investment. You can borrow against it for comparatively low-interest rates because of your underlying asset.

- Banks give lower interest rates because of secured loans. This means the house is collateral if you don’t make your payments.

- You can use the money to pay off debts accumulated during an emergency.

- You can use the money to make improvements to the property.

- Some people use the money to invest in other properties

- Many people use the money when they sell their house to buy their next home.

As you can see, you can use it in a variety of ways. No other asset you have allows you to borrow so much money for such a low-interest rate.4

How do You Build Equity in Real Estate?

Equity builds in a house when you decrease the amount you owe while its value stays the same or increases. There are two ways this happens:

- Reduce the amount you owe on the loan

- The value of the property increases

Ideally, these work together. Sometimes, though, they do not. Property values do, periodically, drop. If this happens, homeowners may find themselves “underwater,” and they owe more than the house is worth. This is called negative equity.

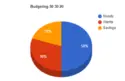

How Long Does It Take?

How long it takes to build equity in real estate depends on many factors. Some of these include:

- How much is your down payment?

- What is the loan term (how many years)?

- Did you improve the property?

- Do you make monthly payments on time?

- Do you pay interest down faster?

- Are housing prices rising?

For most people, it grows gradually, slower in the beginning and then faster toward the end. This is because payments to the bank include mostly interest and little to the principal at first. Later, the percentage going to interest decreases, while the percentage going to the balance increases.

In Your Home For 5 Years

How much equity you have in your home after 5 years depends on how much you put down on and what type of mortgage you have. Above we outlined some factors that affect how much money you have in your home. Most mortgages are either 15-year or 30-year terms.

- 5 years is still early in the life of a 30-year loan, so unless you put down a large amount of money or the housing market escalated you probably don’t have a lot built yet

- For a 15-year loan, you are already 1/3 of the way through the loan, so you should have some built up unless the housing market is bad and prices fell

Your bank statement should tell you the balance, or how much money you still owe. For the other component, market value, Realtor.com is an excellent place to go to see how the market is doing.