Is using your 401(K) to pay off your mortgage a good idea? It may be better to use the money to reduce expenses, like your home loan, before you lose that regular paycheck. At the same time, you lose the compounding value of the money in your retirement account. If you are retired and over 59 ½:

- Your financial situation determines if it is smart to use your 401(K) to retire your mortgage.

- If you are younger than 59 ½ you probably won’t be able to get a hardship to pay off your home.

- If you are not retired, put as much money as you can into your retirement accounts while you can.

Before you retire, you shouldn’t use your accounts to pay off secured loans. After you retire, whether it is a good decision depends on your situation and values.

Click to Open Outline

Smart to Use 401(K) to Pay Off Mortgage?

Whether using our 401(K) to pay off your mortgage depends on your financial situation and priorities. There are good reasons for and against the decision. Advantages of this strategy include:

- Increase cashflow

- Decrease debt

There are also estate planning benefits. Your house is your biggest asset, and there is a big tax advantage in the form of a step-up. That means capital gains is based on the value at the time of your death, rather than when you bought the house. Also, lenders put a due on sale clause into your mortgage, and death often triggers this. It may mean your heirs must sell the house quickly or liquidate other assets to keep the property. If there is no outstanding loan on your home, it makes the process much easier.

These advantages are significant, but there are also disadvantages. They include:

- Fewer liquid assets for your retirement

- Loss of mortgage interest deduction on taxes

- Loss of interest earnings on investments

There may also be a big tax bill. The Internal Revenue Service (IRS) counts any money you take out of your 401(K) as ordinary income. You must pay taxes on the amount you withdraw, and many times it puts you into a higher bracket. Therefore, if you still work it is better to wait until your first year in retirement to discharge your home loan. That way you will not have as much income to push you into a higher tax bracket.1

Hardship Withdrawal

You will probably not be able to get a hardship withdrawal to discharge your home loan. First, your employer must allow it, and many don’t. Second, the IRS states that you can only use this type of withdrawal for immediate and heavy financial need. That may seem ambiguous, but some examples include:

- Some medical expenses

- Home-buying expenses associated with your primary residence

- Up to 12 months of tuition and fees for school

- To stop Foreclosure or eviction

- Funeral expenses

- Expenses to repair casualty losses on your primary residence (fire, flood, and other similar damage)

If you have other assets that you can use, or you have insurance, you will not qualify. If you just want to retire your home loan, you must find another way to do it.

Use 401(K) to Pay Off Mortgage Without Penalty

There is a 10% penalty if you withdraw funds from your 401(K) before you are 59 ½. If you are under, then the only way to avoid the penalty is with a hardship listed above. If you are old enough there is no penalty for taking out a lump sum to discharge your home loan. However, no matter what age you are, you still have income taxes on the money you take out.

Better to Use 401(K) to Pay Off Mortgage or Invest

It is a great idea to reduce debt, but in almost all cases it is better to invest in your 401(K) rather than get rid of your home loan. While Paying off your home loan is a very good goal, it is one of the last debts you should settle. There are many reasons why:

- The interest is very low

- Mortgage interest is tax-deductible

- 401(K)s, IRA, and Roth IRAs have tax advantages

- Employers match 401(K) contributions

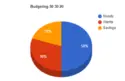

When you get your head above water and you have money after your expenses, you should start an emergency fund. This is the first step. Then, you should fund your 401(K). Next, max out your IRA contributions. After that, pay down unsecured debts. Finally, settle your secured debts, but only if you are in the first few years.

Use Traditional IRA

It may be a good idea to use funds from your traditional IRA to pay off your home loan, but not before you turn 59 ½ and retire. If you aren’t old enough you must pay a 10% penalty, so wait. Similarly, if you take money out while you have a regular income it will probably push you into a higher tax bracket.

With a traditional IRA, your investment grows tax-deferred until you take money out. After that, you pay income tax on the amount you withdraw. The idea is that you have money to live on during your retirement. How you use the money is up to you, and many people want to pay off their mortgage. While there are advantages and disadvantages to paying off your home loan, it comes down to personal preference. There is one caveat, though. If you are at the end of your loan (in the last 5-10 years) you aren’t paying much interest, so it’s better to keep paying the loan and let your IRA grow.

Use Roth IRA

You put after-tax funds into a Roth IRA, and it grows tax-free after that. If you are at least 59 ½ and had the account for at least five years, you can use the money from your Roth IRA to pay off your mortgage without the tax implications of a traditional IRA.2

Set Up a Mortgage-IRA

A Mortgage-IRA is a hybrid model that allows you to pay down your mortgage and allow your IRA to continue to grow. The way to do this is:

- Set up an IRA and fund it from an existing account.

- Put the amount that you owe on your mortgage into the new account.

- Take out the amount you owe just before you make your mortgage payment.

- Make your loan payment like you usually do.

In a way, it is like a shell game, but it is a way to set aside money that is sufficient to pay your home off. With this plan, you get the peace of mind that you have enough money in your account to pay off the loan at any time. You also get the benefit that your money continues to grow while you pay off your mortgage.3

Final Thoughts on Using a 401(K) to Pay Off Mortgage

It is almost always a good idea to get rid of debt. Likewise, it is almost always a good idea to save money for retirement. When these two objectives collide, it can be confusing what you should do. It really depends on your personal preference because there are very good reasons for either choice.

If your focus is on estate planning, you may lean toward paying off your house. On the other hand, if you worry about running out of money then you should keep the money in your IRA.