Budgeting 50-30-20 is a good tool to help you develop a simple budget. It provides guidelines to help you allocate your income properly so that you don’t spend too much or save too little.

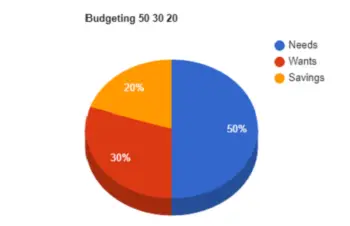

- The strategy focuses on dividing your spending into needs, wants, and savings.

- You set the budget by spending roughly 50% on needs, 30% for wants, and 20% for savings.

- It is a good simple tool that can give you an idea of what is responsible for spending patterns.

It is made for people who are middle class and financially solvent. More complex financial problems often require stringent solutions. However, if you want to start a budget it is a good place to begin.

Click to Open Outline

What is the Budgeting 50-30-20 Strategy?

Budgeting 50-30-20 is a simple guide to help allocate money responsibly. It divides your after-tax budget into three groups. These divisions help you organize your spending.

- Needs – Half of your budget should go toward necessities including your mortgage (or rent), groceries, insurance, medical bills, car payments, etc. It includes anything you must pay for to sustain yourself.

- Wants – 30% of your budget goes toward spending for non-necessities. Eating out, going to a movie, getting that cup of coffee on the way to work all fall into this category.

- Savings – Everyone should have an emergency fund, and 20% of your budget is a reasonable amount to save.

This is a balanced approach that works for most people. You can change it based on your own personality or situation. If you are frugal and want to save more, you may want to adjust the percentages so that you have 20% for discretionary spending and 30% for savings. On the other hand, you may have large debts that take up more than half of your income. You can adjust the plan until you can get your expenses down to that 50% mark.1

How do You Set Up a 50-30-20 Budget?

A 50-30-20 budget allocates money into three groups: needs, wants, and savings. You should set it up by following these steps:

- Determine what your income is

- Calculate all your expenses

- Compare your expenses to your income and see if they are more than half of the money you bring in

- Set aside 20% of your income for savings

- Do not spend more than what is left

It is a simple model, and it is a reasonable guide for most middle-class families. It considers the bills, eating out occasionally, and an emergency fund. However, not everyone is the same. Your situation may dictate a different allocation. Maybe you have an elderly parent in a nursing home, or you have high medical bills from an accident. Maybe you are more frugal and want to save more.

Feel free to adjust the numbers, however, if it is best for you, but keep in mind the underlying principle. You should cover all your expenses, save some money for emergencies, and you should put aside some play money, too.

Budgeting 50-30-20 Example

For example we’ll make up a generic couple with two salaried jobs, a sideline business, and a rental property. They like to eat out and shop on Amazon. They also have two cars to get back and forth to work, and they attend church regularly.

Their first step is to make a spreadsheet that includes their monthly income and expenses. After reviewing their bank and credit card statements they made the following:

| Item | Income | Expense |

|---|---|---|

| Husband Salary | $2,500 | |

| Wife Salary | $2,500 | |

| Sideline business | $800 | |

| Rental Property | $200 | |

| Mortgage (with tax and insurance) | $1,500 | |

| Car payments and insurance | $400 | |

| Phone | $200 | |

| Utilities | $300 | |

| Gas for the cars | $200 | |

| Cable | $100 | |

| Eating out | $600 | |

| Clothes/shoes | $400 | |

| Life Insurance | $200 | |

| Rainy day fund | $900 | |

| Medical insurance | $500 | |

| Other spending | $400 | |

| Groceries | $300 |

They identified the categories by using different colors. Needs spending, they colored blue and found they spend $3,600 in this category. Wants spending, they colored red and found they spend $1,500. Savings, they colored green and found they save $900. So, their ratio is 60% needs, 25% wants, and 15% savings.

They decided that their spending wasn’t too bad, but they need to downsize their needs spending and increase their savings. The best thing to do was to get less expensive cars and get a cheaper cell phone plan. They took the difference and added it to their savings.

You may find that you only need minor tweaks in your budget, but you may also find that you have major problems. In our example, we didn’t deal with major medical bills, out of control credit card spending, or other issues that many people face.2

Is the 50-30-20 Rule Good?

Budgeting 50-30-20 is a good rule to follow for most people because it is a reasonable allocation in most cases. Just be ready to adjust it according to your changing life. Also, keep these issues in mind:

- Use it for after-tax income

- A tithe is first fruits and should be taken out before taxes, so it’s not included

- Retirement accounts, including traditional IRAs and 401Ks, are taken out before taxes and shouldn’t be included

- Food spending can get complicated because it should go in two categories. Groceries should be in needs and eating out should be in wants.

What is good about the plan is that it gives you a goal for a reasonable mix of spending. Even if you can’t achieve that mix right now you can work toward it by adjusting your spending. You may need to downsize your lifestyle or increase your savings. You might need to prioritize your expenses so that you pay off debt.

Final Thoughts on Budgeting 50-30-20

The basic principles of budgeting 50-30-20 are that you shouldn’t spend too much or save too little. If your needs spending is more than half of your budget, you are spending too much, and you need to adjust. Likewise, if your savings are less than 20% then you aren’t saving enough and should reallocate your funds. An emergency can devastate your finances, and you don’t want that to happen to you.

On the other hand, if your necessary expenses are low and you are comfortable then that is not a problem. Also, if you are a saver and you can maintain a comfortable lifestyle for you with increased savings it is a good thing.