Budgeting properly for a house is very important because it is likely the biggest financial decision you will make. If you buy a property with a monthly payment that is more than you can afford you set yourself up for money problems for a long time.

- How do you figure out a budget?

- How do banks use the 28/36 rule?

- Budgeting for first-time buyers

Once you decide what your maximum spending limit should be stick with it and don’t overspend on a home you can’t really afford.

Click to Open Outline

How do you figure out your budget to buy a house?

How much should you spend on a home? You need to start by figuring out your income. A good rule to follow is to not spend more than 25% of your monthly income on your home payment. However, that is just the start.1

Homeownership Costs

Homeownership costs include other things besides the mortgage payment. These include:

- Property taxes

- Home insurance

- Homeowner association dues if necessary

All of these should be easy to find. The property listing should include the taxes and HOA fees (if any), while your insurance company will provide you an estimate of what it will charge. But there are even more expenses to think about.

- Electric and gas bills

- Water and sewer bills

- Lawn maintenance

- Upkeep (this can include minor repairs and cosmetic changes you want to make)

This list can also include things like trash collection and snow removal as well. If the home has a pool that will have even more expenses. You need to budget for these and include them in the 25% limit we discussed earlier.2

Down Payment

The down payment should be a very important consideration for you because it should be a lot of money. We recommend that you save 20% of the purchase price plus closing costs. On average, closing costs run about 4%, and they include:

- Title insurance

- Home inspection

- Attorney’s fees

- Appraisal

- Credit reports

With everything together, you should save at least 25% of the price before you put in an offer. Therefore, if you buy a property that is $300,000 you should have at least $75,000 cash in hand.

You can buy a home with little or no money down, and you can roll closing costs into the home loan, but these are not good ideas. If you put less than 20% down on a property you must pay private mortgage insurance (PMI) which protects the bank. It is usually 1% of the sale price. Also, any amount that you roll into the loan increases your monthly payments.

Do not ever buy a property with less than 10% down because the interest rate will be higher, and you must pay PMI. Terms on these types of loans will not be nearly as good as conventional mortgages, because they build in protections for the lender at your expense.

Mortgage Types

There are many types of home loans on the market today. Most of them are for buyers who really aren’t ready but want to buy a home anyway. Here is what you should always insist on when you choose a loan:

- Conventional – not an adjustable-rate mortgage (ARM)

- 20% down – never pay PMI

- Pay cash for closing costs – never roll these into the loan

- 15- or 30-year term – The shorter the repayment period the better

If you discipline yourself and save as you should then the choice will be clear. A conventional loan will have a lower interest. If you decide to buy before you save that much make sure you do have some savings. 10% down is another threshold that banks look at. If you put down 10% you will pay PMI, but you will still get better terms than if you put little or no money down.

What is the 28/36 Rule When Budgeting for a House?

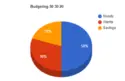

The 28/36 rule is a measure that banks use to decide whether to borrowers. The front-end refers to the maximum percentage of gross income a borrower can afford for housing expenses. The back end is the highest percentage a borrower can spend on all recurring debt and still get approved.3

Front-End

The front-end of the 28/36 rule is 28%. Banks won’t lend more than 28% of your gross income for housing expenses. This includes monthly principal, interest, property taxes, and insurance payments (PITI). It does not include utility bills.

Back-End

The back end of the 28/36 rule is calculated by dividing all recurring monthly payments on your debt by gross monthly income. This ratio includes all debt:

- PITI

- HOA dues

- Credit cards

- Car, student, and personal loans

- Alimony and child support

While it is always a good idea not to carry a credit card balance, it is very important when you want to buy a home.

Budgeting for a House for First-Time Buyers

As a first-time buyer, you may feel overwhelmed with the process of buying a new home. That is natural because it is a big, complicated transaction. On top of that, the professionals you hire have a monetary incentive to encourage you to spend more rather than be frugal.

A great way to begin your search is by deciding that you won’t spend more than 25% of your income on payments and don’t let mortgage brokers or realtors talk you into a more expensive property. It’s a good idea to look online and get comfortable with houses in your price range before you find professionals to work with.

After you decide what you are comfortable paying then sit down with a mortgage broker and get a pre-approval. Your bank may offer a pre-qualification because it is quick and easy. However, a pre-approval requires the bank to verify income.

After you have a pre-approval find a good realtor to help you find a new home and help you through the process. Make sure you tell them your maximum price you will pay.

Final Thoughts on Budgeting for a House

Budgeting for a house is the first and most important step in finding a new home. It is very easy to let any desired features creep up the price. Lenders and realtors will encourage you to do it. If you know why you shouldn’t spend more money you won’t allow any budget creep.