Personal loans are tools you can use to pay off credit card debt. There are pros and cons associated with them that you should weigh against other options as you decide how to deal with your debt.

- Whether it is smart to use a personal loan to pay off credit cards depends on your financial situation and ability to follow a budget.

- Personal loans will negatively impact your score, but they may also help in the right circumstances.

- It is almost always better to pay off revolving accounts before personal loans if you have both.

- A personal loan is an option for consolidation, so it is not better or worse. It is just a possible tool you can use in a larger plan.

You should only consider them within a larger financial plan that includes a budget that you can keep. You can develop a budget and financial plan on your own, or you can seek help from a professional.

Click to Open Outline

Is it Smart to Use Personal Loans to Pay Off Credit Card Debt?

It may be smart to use a personal loan to pay off credit cards in certain situations. Personal can be secured if you put up collateral. It may also be unsecured. Therefore, it has a higher interest rate than a mortgage or home equity loan but lower than your revolving accounts. They do have some advantages, though:

- Typically, they have lower interest rates.

- You can consolidate debts into one account.

- The interest rate is fixed and won’t fluctuate.

That last advantage can also be a drawback because the monthly payment and repayment period are fixed as well. The minimum payment on the card may be lower than your new monthly payment. If you can’t afford that, it may be better to focus on one account and pay that off and then go to the next.

Depending on your credit you can typically get between $1,000 – $5,000. If your debt that you want to consolidate, or move doesn’t fall into that range then you may want to look at other alternatives.

Finally, there are fees associated with opening a personal loan. Most banks charge an origination fee. If the fee is going to be more than the money you save, then you shouldn’t consider this option.1

Do Personal Loans Affect Your Credit Score?

Personal loans do affect your credit score. The effect can be positive or negative depending on your situation.2

How They Help

A personal loan may help if you use it properly. Here are some benefits:

- Credit mix – A variety of credit types helps to raise your scores

- Payment history – On-time payments establish a positive history

- Credit utilization ratio – Because it is an installment loan it doesn’t count against your revolving utilization ratio

These benefits only apply if you manage your accounts properly. Don’t pay off your cards and then run up more charges on them. Also, don’t neglect to make on-time payments. If you don’t manage it well, it will be a detriment rather than a benefit.

How They Hurt

A personal loan is a new debt, and it will have an impact. While there are benefits, some aspects will hurt. Here are some of the negative aspects:

- Credit inquiry – Any time you apply for new debt your lender runs a credit check which hurts your score

- More debt – While you may use it to pay off higher interest obligations, it still potentially puts more financial burden on you

- Fees – Banks charge origination fees to set up the account

Whether it makes sense depends on you and your situation. You should carefully consider the pros and cons of utilizing a personal loan before you sign up for more debt.

Better to Pay Off Credit Cards or Personal Loans First?

If you can pay down balances you may wonder where to start. Your goal is to eliminate as much debt as quickly as you can. Therefore, the best way to decide is to make a table of all your accounts, including the amount owed and the interest rate.

Eliminating a small account quickly can give you a sense of accomplishment but tackling high-interest balances is also important. By comparing each one you can prioritize which to pay first. In some cases, a personal loan with a very low balance may be the place to start, but in most cases, you will want to eliminate credit card balances. Here is why:

- High-interest rates – Revolving credit is always higher

- Credit utilization – This applies to revolving accounts but not to installment debt

Make sure you pay minimum balances on all your debts whichever account you decide to target first. Then, put as much as you can toward paying down the principal on that balance until it is zero. Then move on to the next account.

Better to Get a Personal Loan or Debt Consolidation?

A personal loan is a tool that you can use with any type of debt consolidation, and it may or may not be the right tool for you to use. Likewise, debt consolidation is one option to get a handle on your bills, and you can construct a plan yourself or go to a debt counselor for help. Whatever you decide, there are some steps that you should take before you do anything else:

- List each of your obligations, the amount you owe for each, and the interest rate you pay for each

- Figure out your income and expenses.

- Determine your net income by subtracting your expenses from your income.

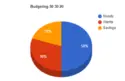

From there decide if you can cut any expenses and set a budget for yourself. This discipline will help you get a handle on your obligations no matter what course you decide to take. We generally encourage people to try to get out of debt on their own, but sometimes the situation is too complicated.

If you feel like you don’t understand how to get solvent, or you need help with the discipline of making a plan then you should contact a HUD-approved financial planning agency.

Final Thoughts on Personal Loans to Pay Off Credit Card Debt

There are different strategies for paying off credit card debt, and a personal loan is one tool that you can use. The pros and cons of this tool have to do with lending limits, credit scores, interest rates, and fees. Taking one out will affect your scores negatively in some ways but may also improve them in other ways.

Whether this is the right tool for you depends on your circumstances, and the best way to understand your situation is to make a financial plan and budget. You can do that on your own, and there are guides that may help. Dave Ramsey and Crown Financial each have excellent programs you can follow. Also, you can seek help from a professional, but we always recommend that you make sure the financial counselor you choose is HUD-approved.