Budgeting for a House: Down Payment costs, Mortgage, 28/36 Rule

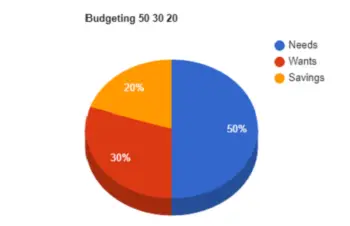

Budgeting is the first step you should do when you want to buy a new house.

Even before looking at properties online or finding a realtor or mortgage broker you should decide how much you are comfortable spending.